⚡️I took a look at @sparkdotfi's roadmap and found that it is no longer satisfied with being just a simple DeFi lending protocol—

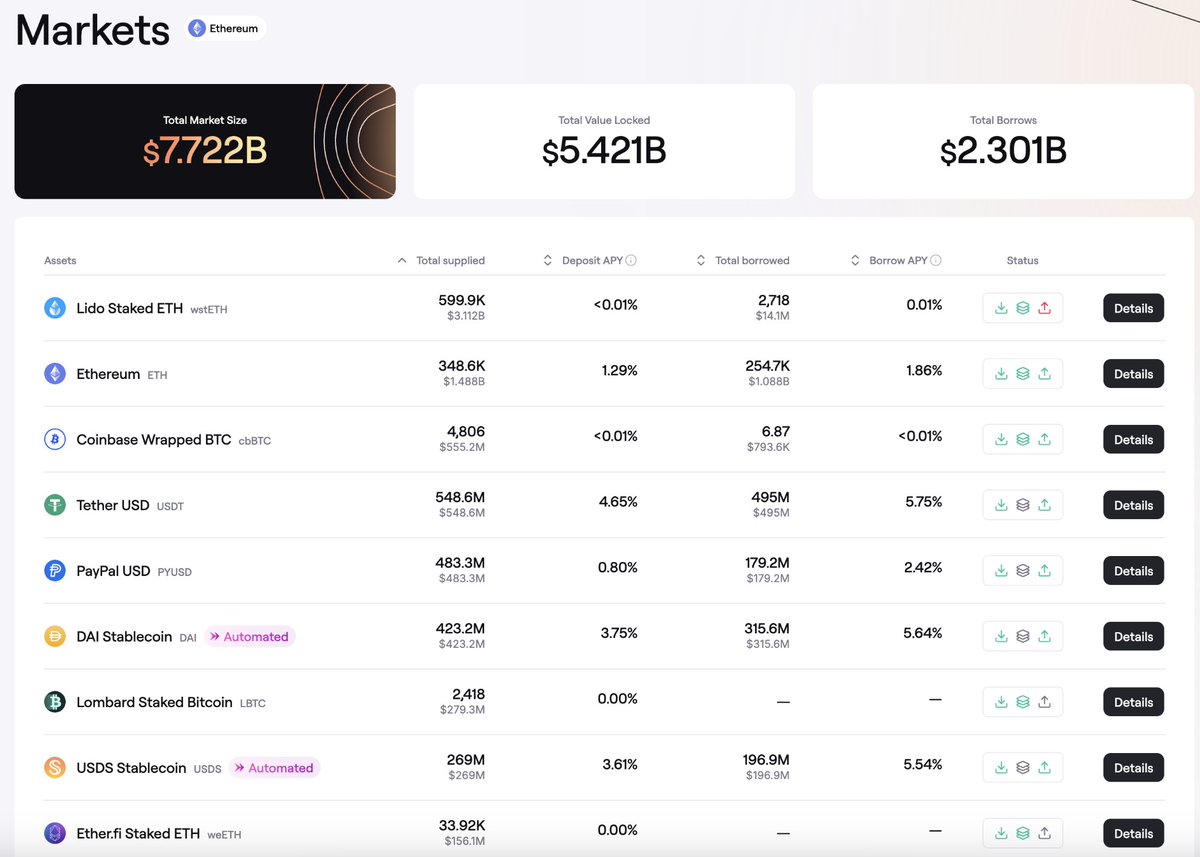

SLL has already deployed billions of dollars in cross-chain funds, and PYUSD has been rapidly ignited on SparkLend. These actions clearly indicate:

Spark aims to establish itself as the foundational layer for stablecoins.

There are two highlights in the roadmap worth noting:

📍Savings V2: Integrating USDC, USDT, and ETH into a "universal savings rate," allowing users to earn the same yield regardless of which chain they are on or what assets they hold, effectively creating a universal savings account on-chain.

📍Institutional Lending: Set to launch by the end of the year alongside Morpho V2, directly offering fixed rates and long-term loans to institutions, with the goal of bringing a billion-dollar bond market on-chain.

A deeper trend:

1⃣ Spark is rapidly integrating with traditional finance, including Coinbase's BTC Borrow, PayPal's PYUSD, and potentially Stripe and Robinhood in the future;

2⃣ Spark is accelerating automation, connecting OTC, exchanges, and Uniswap v4, directly implementing high-frequency market-making logic on-chain.

In this context, if the next wave of DeFi is indeed driven by stablecoin institutionalization, then Spark has the capability to become an engine that can accommodate any stablecoin and any institutional demand.

This is also an inevitable result of the stablecoin narrative reaching deeper waters—

Issuing tokens is becoming easier, but keeping them alive and usable will be Spark's core competitive advantage in becoming the scheduling layer in the future.

I look forward to further development updates! LFG~

Disclaimer: This article represents only the personal views of the author and does not represent the position and views of this platform. This article is for information sharing only and does not constitute any investment advice to anyone. Any disputes between users and authors are unrelated to this platform. If the articles or images on the webpage involve infringement, please provide relevant proof of rights and identity documents and send an email to support@aicoin.com. The relevant staff of this platform will conduct an investigation.