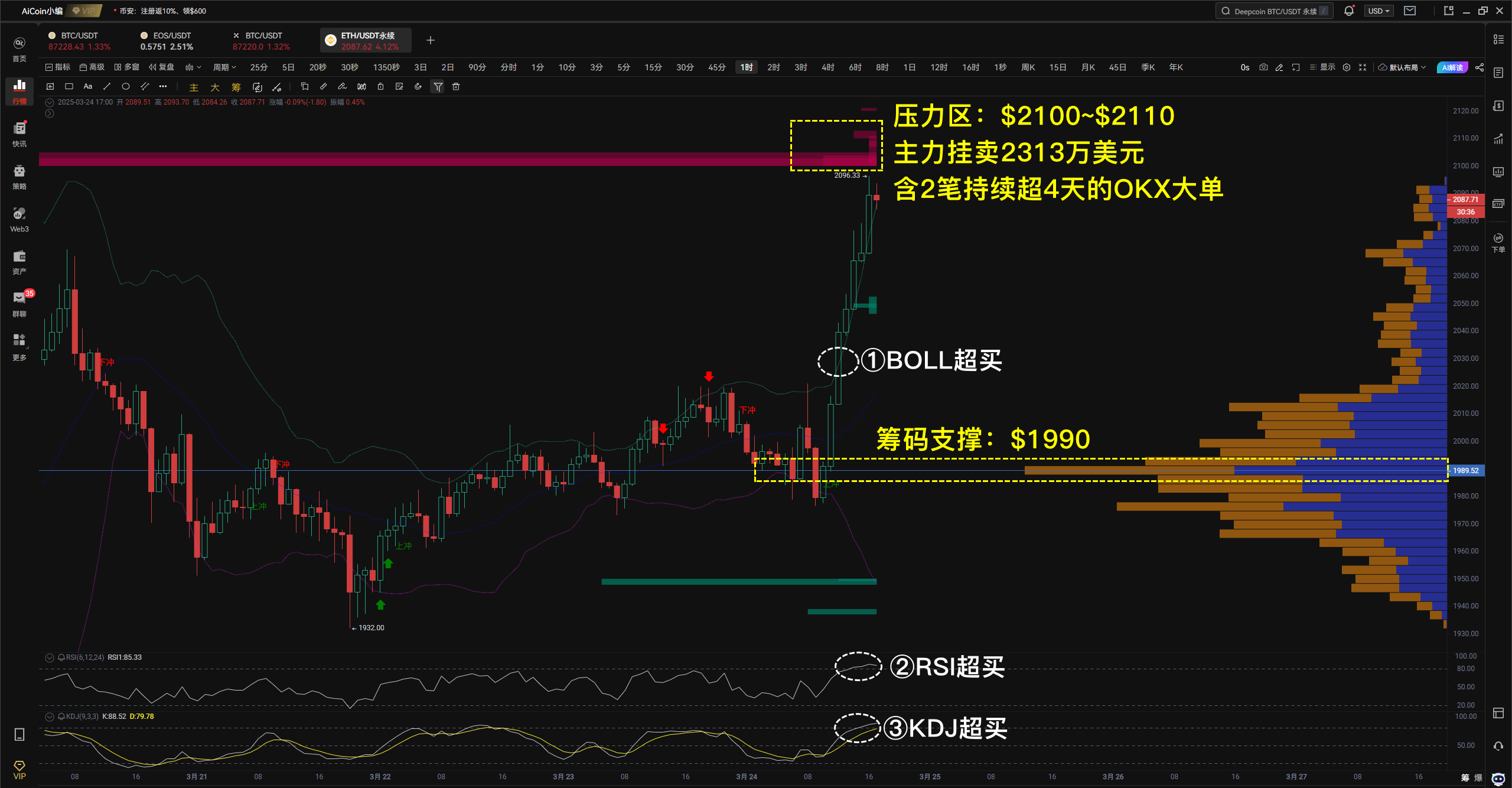

ETH rose strongly within the day, approaching the key pressure zone of $2100~$2110. The main force sold $23.13 million in this range, including two consecutive 4-day OKX large orders, indicating that the main force may suppress the price through "hanging order deterrence", and may face a game in the short term. In terms of technical indicators, BOLL, RSI, and KDJ have shown signs of overbought resonance, indicating a high probability of adjustment demand in the short term. It is recommended to closely monitor the peak support of chips at $1990, which is also located near the lowest price of the vertical demand column and provides strong support. The data is for reference only and does not constitute any investment advice!