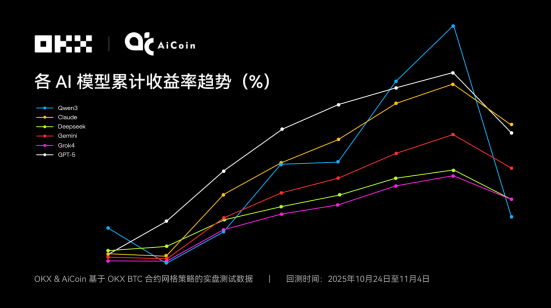

OKX&AiCoin Heavy Review | 6 AI Grid Strategy Duels: Claude Wins the Championship!

Recently, OKX and AiCoin teamed up to conduct six AI model live market evaluations, not focusing on short-term cryptocurrency trading, but on contract grid strategies. Unfortunately, this choice has uncovered the real earnings performance of the six AI models .. [Story Background] This evaluation adopts a minimalist setting: under unified conditions (with each AI investing 1000 USDT and 5-fold leverage), six AI models will be tested in real life from October 24 to November 4, 2025. Based on the OKX BTC/USDT perpetual 1-hour trend chart, provide parameters for an AI grid, including price range and grid quantity, direction (long, short, neutral), and pattern (equal difference, equal ratio). [Evaluation Results] Claude wins the championship, with positive returns for all employees In this evaluation, Claude directly won the championship, while Qwen3, who previously ranked first in the NOF1 race, became the last place. GPT-5 and Gemini performed relatively steadily, taking second and third place respectively; DeepSeek and Grok4 lead to the same goal through different strategies, but their ultimate returns are almost the same. How to outperform the market? From this actual test, it can be seen that AI's strategic capabilities are important, but the role of tools is equally crucial: The strategy tool used in this contract grid experiment is the OKX contract grid (AiCoin AI grid), and all AI execute strategies based on this tool, ensuring consistency and fairness in transaction execution. This is an automated trading tool that supports multiple modes such as equal difference, equal ratio, neutral, long short, etc. It supports custom price ranges, grid quantities, leverage ratios, and other parameters. Suitable for capturing small fluctuations in volatile markets, arbitrage can be achieved by opening and closing positions in batches. How to use AI+grid tools more conveniently? 】 1. Choose the right grid mode: If the market is volatile, use a "neutral grid" for stability; The market has a clear direction, try the "long, short grid" and follow the trend. 2. The interval and number of grids should be reasonable: too narrow can lead to frequent trading, and transaction fees can eat up profits; Being too wide may miss out on band profits. 3. AI provides advice, but don't rely solely on it: AI can calculate parameters and provide direction, but ultimately it still needs to make its own judgments based on market and tool characteristics. 4. First conduct backtesting, then go live: OKX grid tool has a simulation disk function, Aicoin has a historical backtesting function, simulate first to see the effect, and live operation is more reassuring. High risk strategies are always the most unstable part of returns. Only with the right strategy can the potential of AI truly turn into tangible benefits. Next season, we hope to see AI strategies that are more mature, robust, and truly understand risk management. 【 Related Teams 】 OKX Strategy Team: Composed of a group of experienced professionals dedicated to driving innovation in global digital asset strategies, the team includes experts in market analysis, risk management, and financial engineering. OKX has a deep foundation in strategic development, with professional knowledge and rich experience, providing solid support for investors. Register OKX and receive a permanent 20% rebate: https://jump.do/zh-Hans/xlink?checkProxy=true&proxyId=2 AiCoin Research Institute: AiCoin Research Institute is based on the AiCoin platform and is committed to providing in-depth data analysis and investment education for Web3 users. AiCoin is a Web3 data service provider that focuses on intelligence data, professional reports, signal strategy tools, asset management monitoring, and news.