Loading...

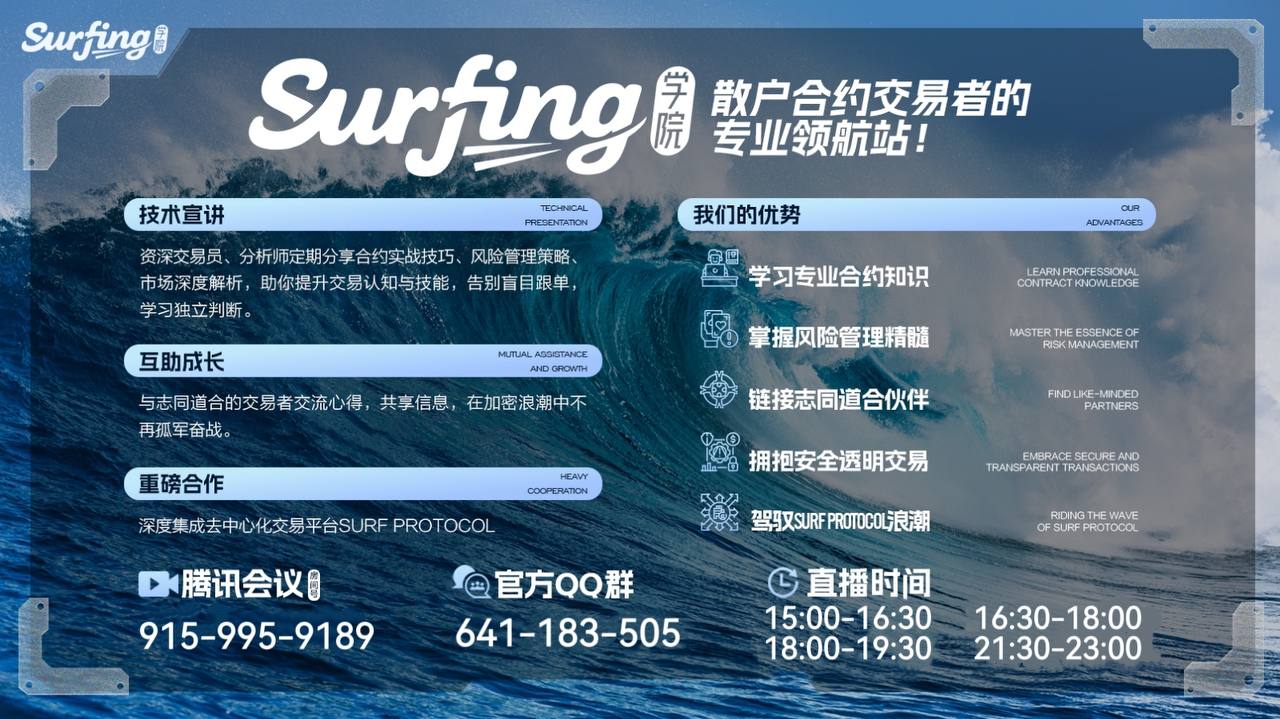

Click on the link to enter Tencent Meeting: https://meeting.tencent.com/p/9159959189 【BTC】 Last night, after hitting $118036, it quickly pulled back above $119000, and the daily chart held the support of $118000 for three consecutive days, forming a "bullish moat". Breakthrough condition: If the CPI data is positive (inflation cools down) and the volume breaks through the resistance of 120500, it will trigger a bearish stampede, with a target of 122000 → 125000 US dollars. Risk of breaking through: Losing 117500 will trigger technical selling, with a deep pullback to 115500 → 113000 (institutional fundraising area). 【ETH】 The convergence end of the triangle is about to erupt. The hourly chart has completed the sorting of the "rising triangle", the MACD golden cross continues, and the opening of the Bollinger Bands expands (BOLL bandwidth breaks through ± 2%). Long position script: Standing firm at $4350 will confirm the breakthrough of Weikov's cumulative mode, with a target of $4500 → $4800 (symmetrical triangle measurement target). Short alert: If it falls below 4200 and closes below it within 2 hours, it may trigger a chain liquidation (ELR leverage ratio reaches a high-risk value of 0.68). Tencent Meeting: 915-995-9189 QQ group: 641183505 Join the Surfing Academy group and enjoy a variety of service offerings 1. Daily free in-depth market analysis and tailor-made account troubleshooting solutions. 2. Lock in the college seat and receive: live streaming of live sales in the evening; Exclusive weekly technical research course updates. 3. High frequency intraday trading signal prompts, seize multiple profitable opportunities during the day. 4. Teach exclusive secrets: "Decryption of Institutional Order Flow", "Tai Chi Tactics", "Time Space Tunnel Trading" 5. Insight into market opportunities by combining "Golden Ratio Expansion", "Long Short Energy Wave (OBV)", and "Application of Fractal Theory". Disclaimer: The above content only represents the author's personal opinion and is for communication and sharing purposes only. It does not represent the position or viewpoint of AiCoin and does not constitute any investment advice. Based on this investment, there may be external contacts, which have nothing to do with AiCoin, and the consequences shall be borne by oneself.