Large transactions reveal short-term direction of BTC: net inflow of $8.41 million, with long positions dominating

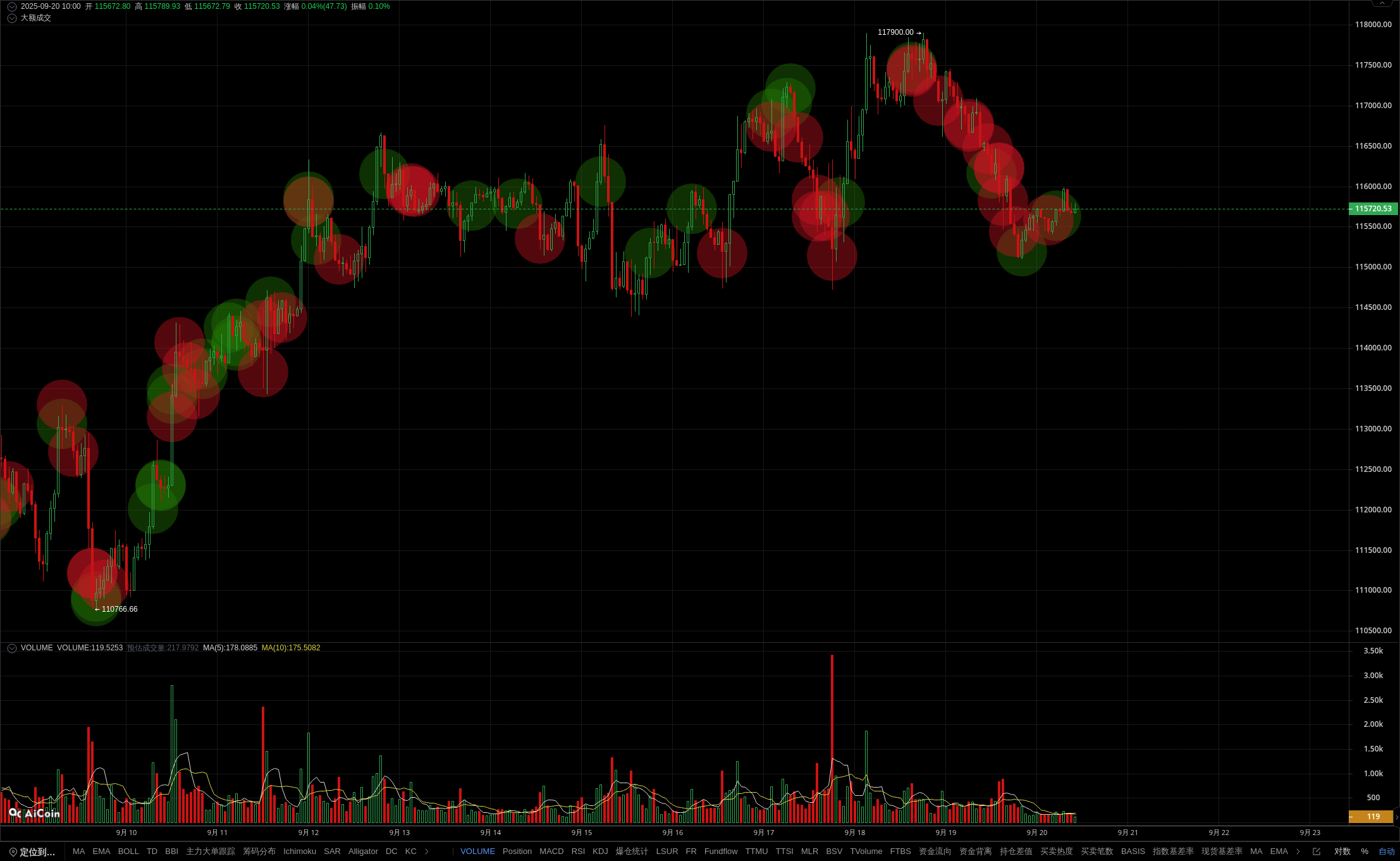

In the past 12 hours, member indicators have shown a net inflow of $8.41 million from large transactions, with a total buying amount of $14.02 million, which is 2.5 times the selling amount. The main funds are clearly biased towards multiple parties. Especially at the large market price of $8.9 million at 13:38, it directly pushed the price from $115630 to $115686. Although there were $1.15 million sell orders suppressing it, buying continued to follow, indicating strong support. The current K-line shows a flat bottomed pattern, coupled with RSI double bottom signals, further verifying the possibility of short-term rebound. However, the price is still below the EMA24/52 moving average, and the medium to long-term trend is weak. We need to pay attention to whether large transactions can continue to guide breakthroughs. Open a membership, grasp the main trends, and quickly lock in opportunities! The data is sourced from the PRO member's [BTC/USDT Binance 1-hour] candlestick, for reference only, and does not constitute any investment advice.