Click on the link to enter the meeting: https://meeting.tencent.com/p/6321551049

1. ETH is currently oscillating in the range of $3000- $3500, forming a falling wedge, with $3000 as the key support (channel bottom+psychological barrier). Technically, RSI 34-37 (close to oversold), MACD negative but with hidden bullish divergence signal, indicates weak selling. Fusaka preheating+Devconnect (launched today) is the catalyst, and the Fusaka upgrade is scheduled to be activated on the main network by the end of November. So the next expectation should refer to the low to high altitude, and 3350 will serve as a turning point for short-term trend changes.

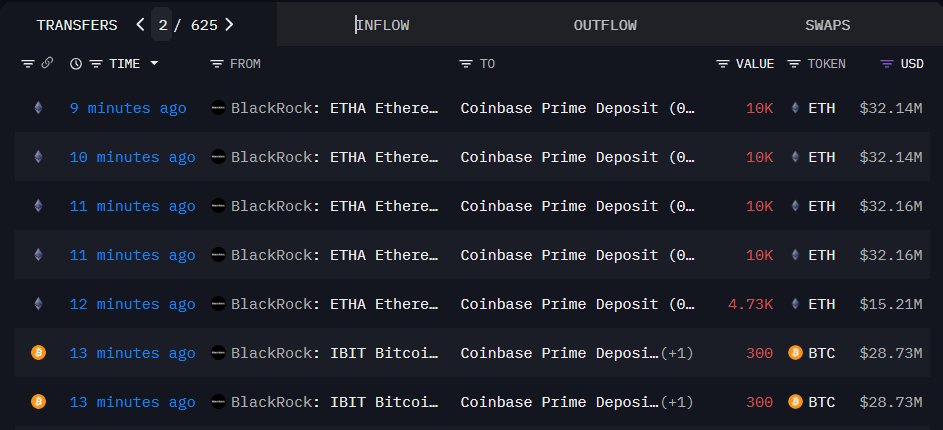

2. The current price of BTC fluctuates within the range of $95000 to $96000, with a 24-hour increase of about 0.25%, but it has fallen by about 5% -6% overall this week, reaching a low of around $93000 (the first time in 5 months). The market sentiment is extremely cautious, with a fear and greed index of 10-18 (extreme fear); But there are positive signals such as institutional accumulation; Whale bottom fishing signals are strong, increasing supply scarcity; The US government shutdown has ended and liquidity has rebounded.

Summary: Today's overall market outlook:

ETH: The position of 3000 has not been broken during testing, and in the short term, a pullback can be mainly supported by 3000-3068; As a secondary support, look at the positions above 3250-3350.

BTC: Chain chip accumulation area of 90000-92000; The price has fallen to 93000 and is supported to make a pullback. There is still a chance to test the price range of 98000-100000 this week. It has become a fact that BTC has fallen below EMA50 in the large structure weekly chart. We should follow the current trend and adopt a strategy of mainly high and then low.

Tonight's focus will be on deviation techniques; Support pressure level, welcome interaction

Disclaimer: The above content only represents the author's personal opinion and is intended to assist investors in understanding information related to the capital market. It does not constitute any investment advice and does not represent the position or viewpoint of AiCoin. The market is risky and investments should be made with caution.