24/7 Flashes

More >Today 2025-12-02

00:48

Coinbase 高管被指控以虚高价格出售价值42亿美元股票

[Coinbase Executives Accused of Selling $4.2 Billion in Stock at Inflated Prices] Coinbase shareholders have filed a lawsuit in Delaware, accusing company executives and investors, including CEO Brian Armstrong and board member Marc Andreessen, of concealing failures in KYC and anti-money laundering compliance, risks of data breaches, and regulatory investigations, while selling $4.2 billion worth of company stock at inflated prices. The plaintiffs claim that Coinbase was aware as early as January this year that hackers had obtained sensitive user information through a third-party customer service provider but did not disclose the data breach until May. Shareholders are seeking billions of dollars in damages, as well as board seats and greater influence over company policies. Additionally, Coinbase announced last month its plan to relocate its headquarters to Texas.

00:45

币安完成首批6837.99枚GIGGLE手续费捐赠与销毁

[Binance Completes First Batch of 6,837.99 GIGGLE Fee Donations and Burns] GiggleFund announced that Binance has completed the first batch of GIGGLE transaction fee donations and burns. Data shows that between November 1 and 29, 2025, Binance generated a total of 6,837.99 GIGGLE in spot and margin trading fees, equivalent to approximately $975,700. Half of the fee tokens were donated to Giggle Academy, while the other half was burned, permanently reducing the circulating supply. Relevant transaction IDs have been made public.

00:43

The address of the giant whale has deposited 10200 ETH into Kraken, worth 28.69 million US dollars

Monitoring shows that the address 0xd908995fd431eb0078cd35e912ff14e45043818f of the giant whale deposited 10200 ETH (worth $28.69 million) into Kraken, which had been held for 100 days after being converted from SETH. The address can be traced back to 5 years ago, when 21000 ETH (worth 7.35 million US dollars) were initially withdrawn and gradually deposited back into the exchange. (Onchain Lens)

00:42

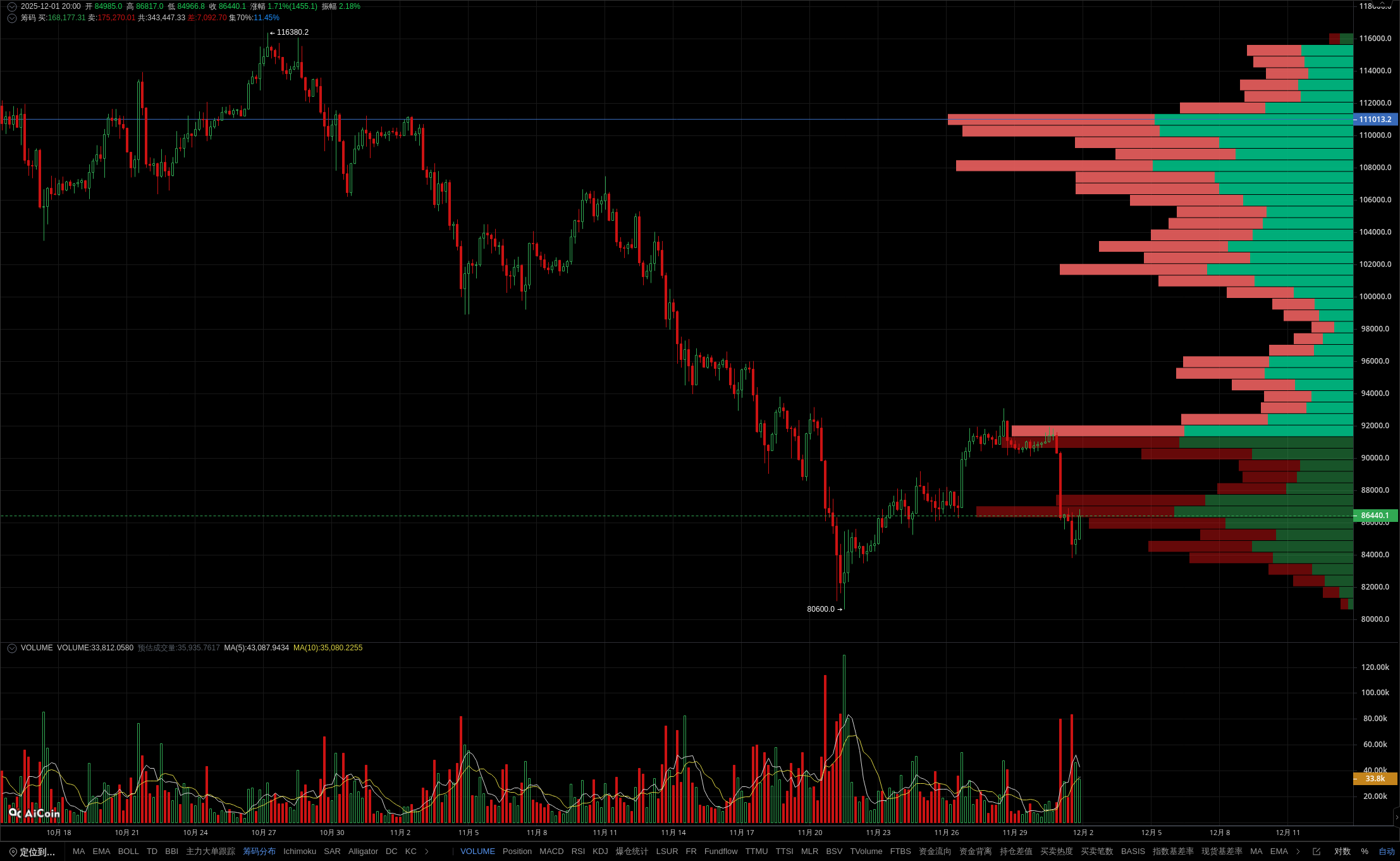

比特币挖矿利润降至历史低点,行业面临生存压力

[Bitcoin Mining Profits Drop to Historic Lows, Industry Faces Survival Pressure] According to the Miner Weekly report, impacted by Bitcoin's sharp correction in November, unit hash rate revenue has dropped from $55 to $35 per PH/s, below the median total cost of approximately $44 per PH/s for publicly listed mining companies. Meanwhile, the total network hash rate is approaching 1.1 ZH/s, and the payback period for the latest mining machines has exceeded 1,000 days, surpassing the timeframe for the next halving. CleanSpark recently repaid Bitcoin-backed loans and raised over $1 billion in financing, while mining companies such as Cipher and Terawulf collectively raised over $5 billion in the fourth quarter. The industry is shifting toward deleveraging and liquidity management, entering a new phase of survival screening.

00:42

某ETH波段大户卖出2287枚ETH,仅获利3.3万美元

[An ETH swing trader sold 2,287 ETH, earning only $33,000] Crypto analyst Ai Yi's monitoring shows that approximately 9 hours ago, an ETH swing trader sold 2,287 ETH in a single on-chain transaction, with a total value of approximately $6.32 million at a selling price of $2,766.38 per ETH. This batch of ETH was acquired a week ago at a price of $2,781.26 per ETH. During this period, the unrealized profit reached as high as approximately $703,000, but due to the failure to take profit in time, the final profit was only about $33,000.