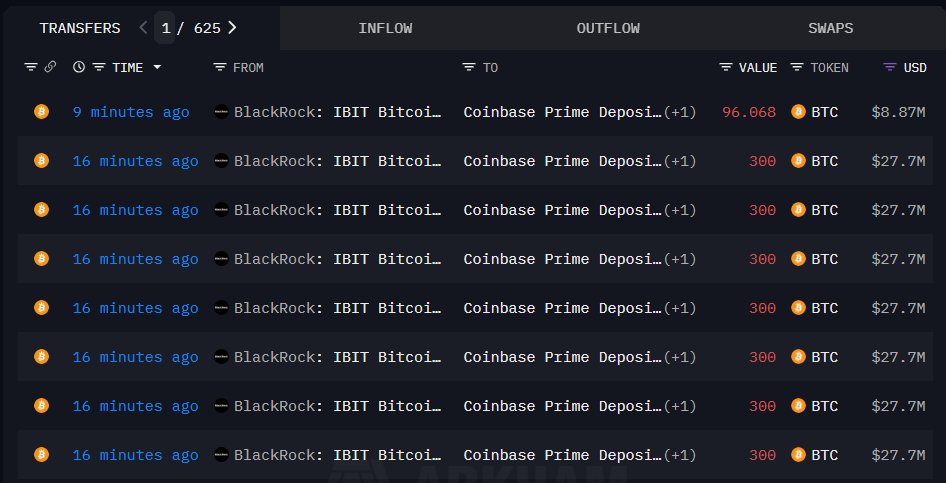

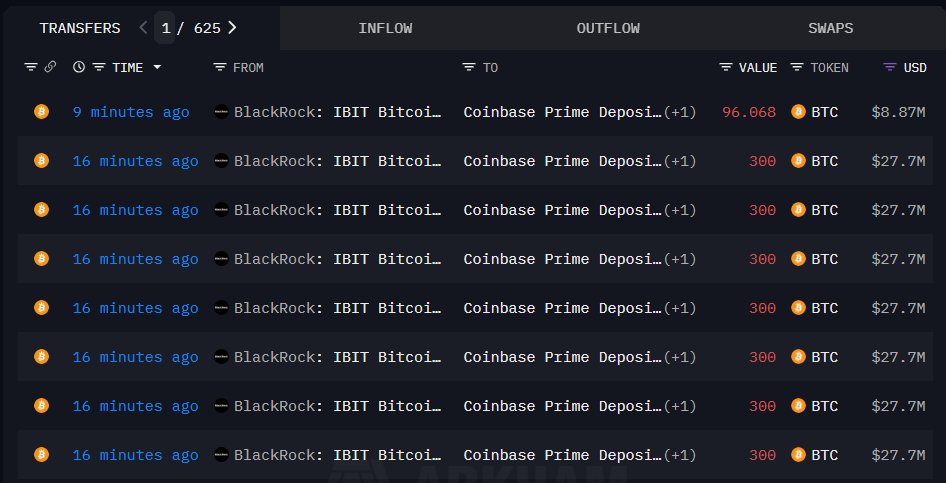

BlackRock deposits 2196 BTC worth $202.76 million into Coinbase

On chain data shows that BlackRock deposited 2196 BTC worth $202.76 million into Coinbase. (Onchain Lens)

On chain data shows that BlackRock deposited 2196 BTC worth $202.76 million into Coinbase. (Onchain Lens)

[Japan's Financial Services Agency Plans to Regulate Crypto Assets Under the Financial Instruments and Exchange Act] The Financial Services Agency of Japan has released a report outlining plans to shift the regulatory framework for crypto assets from the Payment Services Act to the Financial Instruments and Exchange Act. The new framework will require enhanced IEO disclosures, with project teams obligated to disclose their identities and token distribution models. Regulatory authorities will intensify efforts to crack down on unregistered platforms and prohibit insider trading. Additionally, the Japanese government is considering standardizing the tax rate on crypto trading profits to 20%. The Financial Services Agency remains cautious about granting licenses for overseas crypto ETF derivatives.

[Fidelity: Approximately 430,000 Bitcoins Bought at $85,500, Potential Key Support Level] Fidelity's subsidiary, Fidelity Digital Assets, posted on the X platform stating that Bitcoin has regained upward momentum as macroeconomic expectations shift, with the current price fluctuating in the $90,000 range. Transaction data shows that around 430,000 Bitcoins were purchased near the $85,500 level, indicating that this price point could serve as a key support level. The market volatility has now stabilized, and Fidelity will closely monitor the market's reaction to today's Federal Reserve meeting.

Coinbase, with a market value of $90 billion, expects more European countries to follow the example of the Czech Republic in purchasing Bitcoin. (The Bitcoin Historian)

[Market Expects Fed to Cut Rates by 25 Basis Points, Trump Prepares to Interview Powell's Successor] The market widely anticipates an 88% probability that the Federal Reserve will cut rates by 25 basis points this week. Weak labor market data and stable inflation levels support the rate cut expectation, but the lack of new economic data has led to internal disagreements among Fed officials. Chair Powell may warn that future policy will depend on upcoming data while implementing the rate cut. The market still expects the Fed to cut rates again in January next year. Additionally, President Trump is preparing to interview candidates to succeed Powell next year.

[ETHZilla Acquires 15% Stake in Zippy for Approximately $21 Million and Tokenizes Mortgage RWAs] ETHZilla has acquired a 15% stake in the digital mortgage platform Zippy for approximately $21 million and reached an agreement to tokenize manufactured home loans as on-chain RWAs. Zippy focuses on the U.S. manufactured home market, which has an annual financing scale of $14 billion. Over the next 36 months, its on-chain operations will exclusively utilize ETHZilla-owned platforms such as Liquidity.io, aiming to provide institutional investors with on-chain bond purchasing channels.