Loading...

Suspected BitMine Wallet Withdraws 23637 ETH from Kraken, Approximately $73.4 Million

--

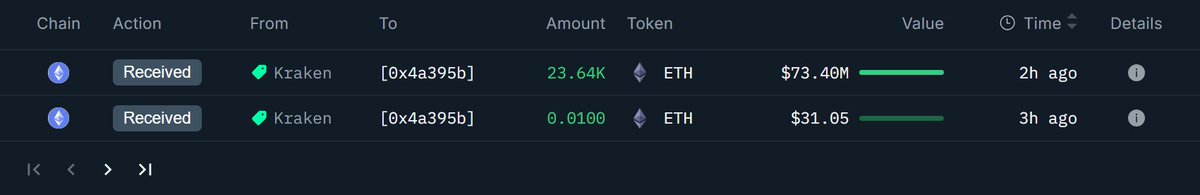

Onchain Lens monitoring shows that a newly created wallet has withdrawn 23637 ETH from Kraken, worth approximately $73.4 million. The wallet address is suspected to belong to BitMine. (Onchain Lens)